UK DIY & Gardening Sector Report summary

November 2025

Period covered: Period covered: 05 October - 01 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

DIY & Gardening Sales

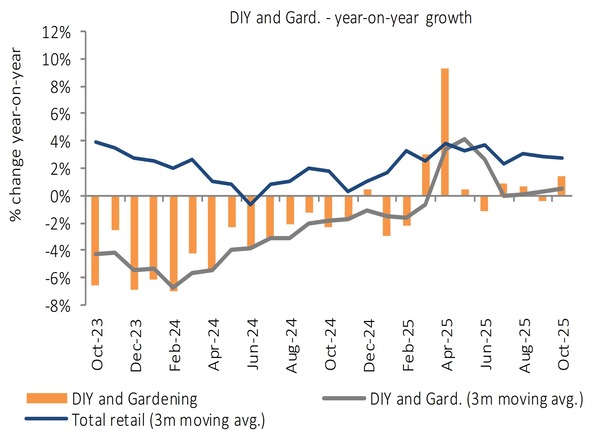

DIY and gardening sales rose by xx% year-on-year in October, reversing the decline seen in September and outpacing the xx% growth recorded in the same month last year.

This improvement was driven by seasonal trends extending later into the year with continued consumer interest in home maintenance and outdoor projects.

Key trading themes and drivers

Extended gardening season: Unusually mild weather supported demand for gardening goods well into October. The Horticultural Trades Association (HTA) reported year-on-year growth of xx% in garden centre sales during the month, with strength in autumn bedding plants, bulbs, and outdoor living accessories. Customers also engaged in late-season landscaping and garden refresh projects.

Home maintenance and minor improvements: Retailers recorded steady demand for DIY products, especially seasonal maintenance items. Sales were often driven by practical needs rather than major renovations, with customers focused on energy efficiency and preparing homes for winter.

Halloween-related footfall: Garden centres and DIY stores benefited from Halloween events and seasonal displays, which helped lift traffic during weekends and half-term. Decorative lighting, outdoor displays, and novelty stock created additional impulse purchases.

Selective promotional activity: Discounting was less pronounced than in other non-food sectors, as DIY and gardening retailers held prices firm ahead of expected Black Friday campaigns. However, there was targeted activity around autumn-themed and energy-saving products, particularly items linked to heating and insulation.

Housing market activity

The housing market remained subdued in October, with Nationwide recording axx% year-on-year fall in average house prices and low transaction volumes.

Mortgage approvals were weak, reflecting the impact of elevated borrowing costs.

For the DIY and gardening sector, this translated into ongoing interest in lower-ticket projects. Customers appeared focused on projects that either preserved property value or improved energy efficiency

Macroeconomic backdrop

The wider economic picture in October remained difficult, but with some stabilisation in key indicators.

Consumer confidence showed conflicting signs in October, with the headline rate rising two points to -xx, which included a four-point rise in the major purchase index as shoppers warmed up for Black Friday. However, confidence in household finances remained unsteady, with the continued elevated cost of living remaining on the list of consumers’ worries.

Inflation eased to xx% (CPI), driven by slower growth in goods prices and energy costs but food inflation edged up to xx% having fallen back in the previous month.

Wage growth, slipped to xx% but remained slightly ahead of inflation, offering real income gains. However, the labour market showed signs of cooling with unemployment rising to xx% while vacancies plateaued.

Outlook

The DIY and gardening sector enters the final months of the year with cautious optimism. While overall spending remains restrained, seasonal engagement, practical household needs, and mild weather have extended trading opportunities.

Garden centre sales remain a relative bright spot, particularly for retailers with strong seasonal programming and events. With Black Friday approaching, promotional planning will be key, especially for indoor projects and energy-saving categories. Provided the weather turns colder and promotional activity is well-targeted, November could sustain or build on October’s gains.

Take out a FREE 30 day membership trial to read the full report.

October sees DIY & Gardening buck the discretionary slowdown

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted