UK DIY & Gardening Sector Report summary

May 2024

Period covered: Period covered: 31 March – 27 April 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

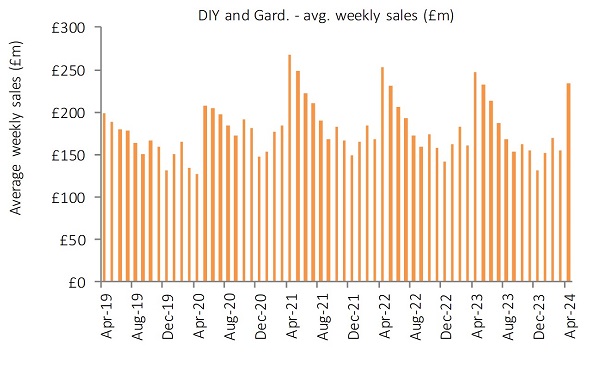

DIY & Gardening Sales

DIY & Gardening sales declined by xx% YoY in April, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

ONS data shows the wider Household Goods category faced shop price inflation of xx% in April.

Within household goods, both DIY & Gardening and Furniture & Flooring (xx%) experienced a similar decline in sales, while Homewares (xx%) performed relatively better.

Subdued garden centre sales

A combination of Easter falling at the end of March and unfavourable weather conditions contributed to weaker garden centre sales in April, according to the GCA.

Sales of products in xx of the GCA’s 13 categories fell on an annual basis in the month, including garden sundries (xx%), seeds and bulbs (xx%), and houseplants (xx%).

Steeper declines were recorded for outdoor plants (xx%) and furniture and barbecues (xx%), with the latter reflecting wider reluctance to spend on big ticket items.

Essential spend driving sales

As spending on discretionary and big-ticket DIY & Gardening products come under pressure, retailers are striving to maximise returns from sales of essential products as well as to entice reluctant consumers to spend on discretionary home improvements where possible.

Wickes reported a steep 18.2% fall in design and installation sales in the 16 weeks to 20 April 2024. On the other hand, interior paint sales grew by 13% as consumers were more willing to embark and spend on smaller, more affordable home improvements projects

The retailer reported a weak rise in retail sales of 0.6% compared with a 4.2% drop in like-for-like sales in the period, attributing the former to its price cutting activity as well as an increase in transactions.

Large-scale home improvements projects have arguably been the hardest hit by recent macroeconomic challenges. However, focusing solely on promoting smaller products and projects is not the only strategy for retailers in the sector to succeed.

Wilko launched a collection of affordable and self-assembly kitchens in April. The collections include pre-inserted cams and dowels, which allow consumers to forego hiring a fitter.

Take out a FREE 30 day membership trial to read the full report.

DIY & Gardening avg. weekly sales

Source: Retail Economics

Source: Retail Economics