UK DIY & Gardening Sector Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

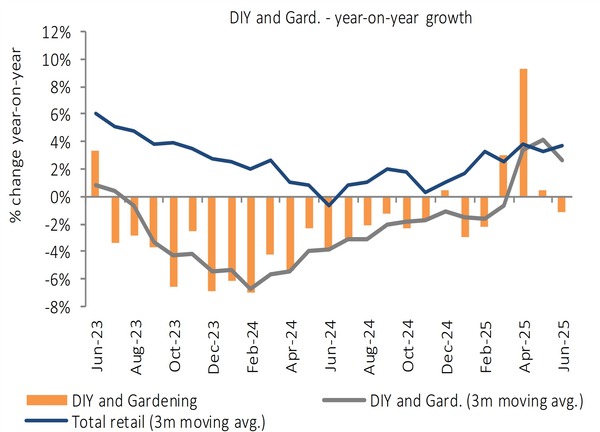

DIY & Gardening Sales

After a strong spring, DIY and Gardening fell xx% year-on-year in June making it the worst performing retail category, as buyers remained hesitant on bigger home projects amid affordability concerns.

Footfall marginally rose by xx% in June 2025 (MRI software) compared to last year across all UK retail destinations, the slow start due to post half-term slowdown and unsettled weather was offset by major concerts and sporting events towards the end of the month.

The exceptionally warm spring, culminating in the sunniest April on record, continues to skew seasonal trading in the DIY and Gardening category.

Housing market keeps the positive momentum

The UK housing market showed tentative signs of stabilisation in June. According to the RICS June survey, new buyer enquiries turned positive for the first time since December 2024, with a +xx% net balance.

Agreed sales, though still slightly negative, improved significantly from earlier months, as they jumped to -xx% (net balance) compared to -xx% and -xx% in the two previous surveys.

While near-term sales expectations also brightened, with a +xx% net balance, up from -xxin May. While momentum remains limited, the figures point to a stabilisation in activity rather than outright growth.

Mortgage rates remain a pivotal factor. Although the Bank of England held rates steady at xx% in June, but lender competition is driving cuts across fixed-term mortgage products. Several lenders reduced rates, with some sub-5% deals returning for first-time buyers.

Encouragingly, it is anticipated that interest rates will fall further this year, with markets currently pricing in two quarter-point reductions by the end of 2025 helping to improve affordability.

This is likely to bolster consumer confidence, which if sustained, could feed into modest DIY spending later in the year. Particularly for home maintenance and preparatory improvements by prospective movers.

Garden centre sales weakened

Garden centre sales cooled as earlier warm weather pulled forward demand, dampening peak-season sales. Water supply concerns and heat stress have also challenged trading conditions, especially in live plant categories. This resulted in a -xx% dip on year-on-year sales in June.

In contrast, non-gardening sales rose by xx% year on year, supported by a xx% year-on-year growth in garden centre cafes, aided by the second hottest June on record aiding footfall (HTA).

The sector continues to face mounting pressure from rising costs including increased shipping rates, labour shortages and higher wage bills, all of which are compressing margins. While Garden centres have absorbed much of this strain to date; their pricing flexibility is narrowing as the sector heads into the final months of the peak season.

Growth Holds On as Manufacturing Slide

Real GDP grew by xx% in the three months to May, despite the recent monthly contractions.

Services output rose by xx% in May, following a -xx% fall in April. Meanwhile, the production, manufacturing and construction sectors all contracted by xx%, xx% and xx%, respectively.

DIY and gardening is projected to grow by xx% this year, demonstrating resilience amid broader macroeconomic uncertainty and growing consumer caution.

Take out a FREE 30 day membership trial to read the full report.

DIY & Gardening sales decline in June

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted