UK DIY & Gardening Sector Report summary

February 2025

Period covered: 29 December 2024 – 01 February 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

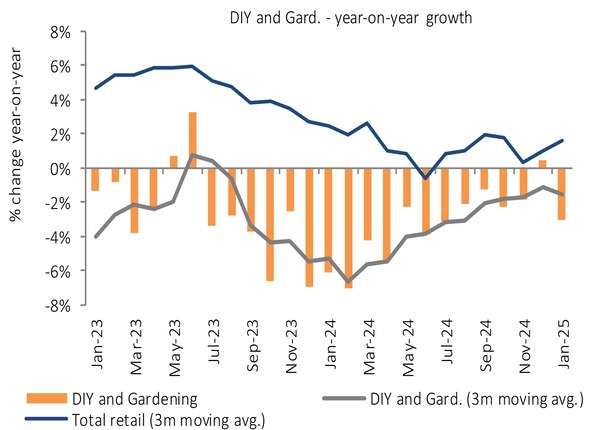

DIY and Gardening sector experienced a notable decline in January 2025, with sales falling by xx% year-on-year, marking a deepening of the downward trend from the previous quarter's -xx%.

Over the past year, the sector has been struggling, with a 12-month average decline of -xx%. This weak performance is reflective of subdued consumer demand.

Key factors that influenced this performance include:

Adverse Weather affecting Garden Centres Performance

Severe weather disruptions significantly impacted consumer behaviour in January. The UK saw record low temperatures and strong storms, including Storm Eowyn and Storm Herminia, leading to travel disruptions and limiting outdoor activities.

As a result, outdoor plant sales in garden centres saw a decline of -xx%, while hard landscaping and furniture & BBQ sales dropped by -xx% and -xx%, respectively, according to the Garden Centre Association’s (GCA) Barometer of Trade (January 2025).

Value and Wellness Focus

The growing focus on health and value-driven spending in January led to a shift away from discretionary purchases. According to Barclays, non-essential spending grew by xx% YoY in January, with significant spikes in wellness-related categories. Sports nutrition sales surged by xx%, and non-alcoholic beverage sales rose by xx% YoY, driven by the Dry January trend.

Consumers were more focused on health-related goods rather than discretionary items, such as gardening supplies, further contributing to the downturn in DIY and Gardening sales.

Flailing Consumer Confidence

The GfK Consumer Confidence Index showed a sharp decline, dropping xx points to -xx in January 2025, the most significant start-of-year drop since 2011.

With uncertainty surrounding future economic conditions, consumers remained cautious, prioritising savings over spending on non-essential items like gardening supplies.

Inflationary Pressure

Inflation continues to exert significant pressure on consumer spending, particularly in essential categories. The ONS reported a xx% increase in inflation in January 2025, driven by higher transport and food prices, as well as rising energy costs.

This ongoing inflationary pressure, coupled with expected further increases after the Autumn Budget 2024, has made households more cautious about discretionary spending, directly impacting DIY and Gardening performance.

Housing market slowdown amid economic pressures

The housing market showed signs of a slowdown in January 2025, with house price growth moderating to xx% YoY (from xx% in December 2024), as reported by Halifax.

This slowdown in property prices is compounded by affordability constraints and rising borrowing costs, which have reduced the number of housing transactions.

This, coupled with inflationary pressures (reported at xx% by the ONS in January), continues to suppress consumer confidence and demand in discretionary sectors.

Take out a FREE 30 day membership trial to read the full report.

DIY & Gardening sales declined

Source: Retail Economics, ONS, seasonally adjusted

Source: Retail Economics, ONS, seasonally adjusted