UK DIY & Gardening Sector Report summary

August 2025

Period covered: Period covered: 06 July – 02 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

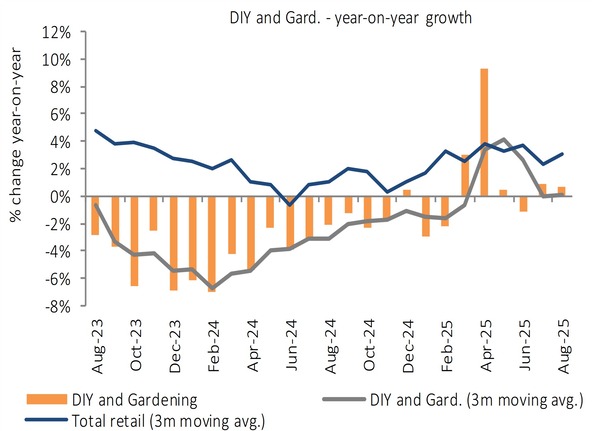

DIY & Gardening Sales

DIY & Gardening sales rose by xx% year-on-year in July, a welcome improvement from last month’s decline. This marked the sector’s fourth positive month out of the last fifth, though growth remains modest and heavily influenced by weather and household confidence.

Footfall marginally rose by xx% in July 2025 (MRI software) compared to last year across all UK retail destinations. Retail parks were one of the main beneficiaries of July’s activity, drawing families into larger DIY and garden stores during warmer weekends.

Key trading themes and drivers

Seasonal lift: The early-month heatwave encouraged outdoor projects. Garden centres saw brisk trade in plants, lawn care and summer furniture before momentum eased later in the month.

Practical focus: Smaller upgrades and quick fixes continued to dominate over major projects, with paint, tools and decorative ranges performing more steadily than high-value renovations.

Weather dependency: Cooler spells and school holidays slowed activity as households prioritised leisure and travel over home improvement.

Garden centre sales weakened

Garden centre sales grew steadily in July 2025, up xx% year on year, driven by higher footfall. Non-gardening categories, especially indoor living (+xx%) and catering (+xx%), outperformed, while outdoor furniture sales surged xx% from July 2024.

The sector continues to face pressure from rising operating costs and water scarcity remains a concern, with drought persisting in several regions, which resulted in temporary use bans, which challenged peak-season trading conditions for plant categories.

While July’s growth shows resilience in non-gardening and high-ticket categories, continued water scarcity and weak live plant sales signal risk to core gardening revenues into late summer.

Rising input costs also threaten margins. Pushing reliance on non-gardening, catering, and homeware categories to sustain revenue momentum through Q3 and Q4.

Housing market keeps the positive momentum

Bank of England reported lenders approved the most mortgages in July since the start of the year, with xx mortgages signed off. Additionally, the housing market continued its positive momentum July as the Halifax House Price index indicated that the average house price increased by xx%; the largest monthly increase since January 2025.

This momentum continued into August as house price rose month-on-month by a further xx%. Aided by falling interest rates and wage growth growing outpacing house price in inflation for the past three years, improving the affordability for first time buyers and those households wanting to move up the housing ladder.

However, this momentum is anticipated to slow as RIC reported that new buyer enquiries fell to net balance -xx% (down from +xx% in June). While Market appraisals (Property valuations conducted by estate agents) were at +xx%, the weakest since Dec 2024, indicating a flatter pipeline ahead. This will likely be aided by slowdown in interest rate cuts as markets anticipate around a xx% chance of another rate cut this year.

Take out a FREE 30 day membership trial to read the full report.

DIY & Gardening sales rose in July

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted