UK DIY & Gardening Sector Report summary

April 2025

Period covered: Period covered: 02 March – 05 April 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

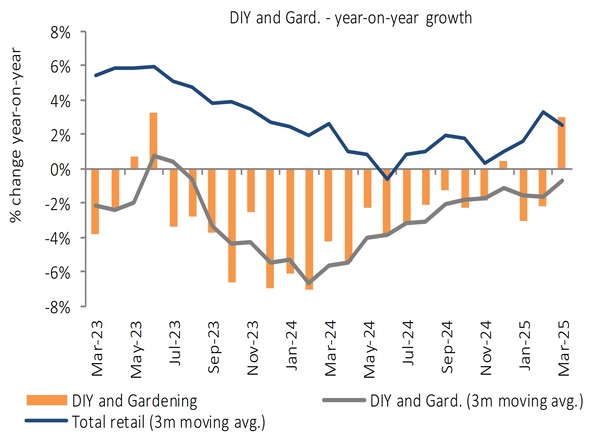

DIY and gardening was the third strongest retail performer in March, with sales up xx% year-on-year, despite the prior year benefiting from Good Friday and Easter Saturday trade. Warmer weather this year encouraged households to invest in improving their outdoor space.

Warm and dry weather prompted seasonal planting, while squeezed household budgets were resilient as they increased their discretionary project spend.

However, with a 12-month average decline of nearly -xx%, the category remains structurally challenged ahead of the crucial spring trading period. Especially as a range of rising costs are expected to put downward pressure of retailer’s margins.

Weather improves Gardening demand

- The third sunniest March since records began improved gardening activity in March, encouraging footfall at garden centres, as households made initial investment in their outdoor spaces.

- According to the Met Office, March 2025 was warm and dry across the UK, with temperatures xx°C above average. It was the tenth warmest March, the sunniest March for England, and the third sunniest for the UK overall on record.

- This weather directly impacted consumer behaviour, with many making the most of the dry weather and beginning to prune their gardens as sales of live plants, seeds, and other seasonal products improved.

- Retailers are now looking for continued strong seasonal sales as Easter approaches amid a myriad of rising costs, including increased employers' national insurance contribution and labour costs.

Big-ticket spending remains constrained

- Consumer appetite for large-scale home improvement projects rebounded in March, helped by the weather, although the 12-month average remained subdued amid continued financial caution as the saving rate continues to rise.

- The RICS March survey recorded further deterioration in both buyer enquiries and agreed sales, reflecting affordability constraints among rising costs and a continued high-interest rate environment

- Nevertheless, March was likely aided by a lag affect from the boost from individuals trying to beat the rise in stamp duty pre-April.

Economic uncertainty weighs on DIY

- March showed a more resilient picture as GDP grew faster than expectation to xx% month on month. However, growth throughout the year is expected to be dampened by inflationary pressure from tariffs and domestic policies from the autumn budget.

- These downward pressures has led to the IMF to downgrade the UK GDP from xx% to xx%.

- Sluggish growth, elevated borrowing costs, and a weak housing market are dampening major DIY investments. However, expectations of further interest rate cuts, positive real wage growth, and strong household savings growth in prior years are expected to boost DIY and gardening sales by xx% in 2025.

Take out a FREE 30 day membership trial to read the full report.

DIY & Gardening sales improved

Source: Retail Economics, ONS

Source: Retail Economics, ONS