UK Clothing & Footwear Sector Report summary

September 2025

Period covered: Period covered: 03 August - 30 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

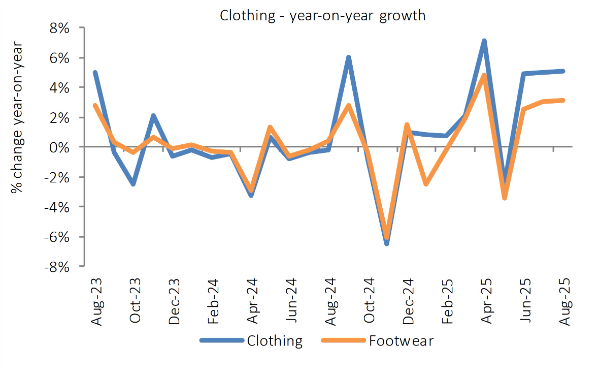

Clothing and footwear sales continued its growth in August, with clothing up xx% year-on-year and footwear rising xx%.

This marked an improvement from the three-month average xx% rise for clothing, supported by summer clearance events, sustained warm weather, and end-of-holiday purchases.

Key sales drivers

Retailers leaned heavily on discounting to clear summer stock, which drew shoppers into stores and boosted volumes.

Value remained a decisive driver, with consumers trading down for basics yet willing to pay for standout items in occasionwear or sportswear.

August was warm and drier than average, featuring a mid-month heatwave, which helped sustain sales of summer lines, from dresses and swimwear to casual footwear.

When temperatures began to cool later in the month, transitional autumn ranges were slower to gain traction.

The back-to-school period provided only limited uplift, with reports of families delaying or economising on uniforms and school shoes.

Events and holidays supported demand for occasionwear, with weddings and social gatherings driving formal categories, while sportswear continued its strong run, buoyed by athleisure trends and youth fashion.

Category performance

Women’s outerwear was among the strongest categories, lifted by summer dresses, holiday wear, and improved demand for event-led purchases.

Occasionwear saw higher interest than earlier in the year, as social calendars remained busy into late summer.

Menswear was steadier, while Children’s clothing and footwear underperformed seasonal expectations. Many families opted for second-hand or recycled uniforms, limiting fresh demand.

Sports shoes and trainers did well, but the usual late-August surge in school footwear sales was softer than hoped.

Accessories played a supporting role, with sunglasses, holiday bags, and seasonal items still in demand early in the month, though sales tapered as the school term approached.

Outlook

August offered a much-needed rebound for clothing and footwear, giving retailers confidence heading into the autumn. Clearance sales were a success, but margins remain tight.

The test will come as cooler weather sets in, and shoppers weigh up discretionary spend against higher utility bills and food costs.

Apparel should see a lift from autumn fashion, while footwear demand will hinge on seasonal lines and whether delayed school purchases flow through into September.

With confidence fragile, growth will depend on value-led propositions, sharp promotional strategies, and the ability to spark shopper interest in new-season ranges.

Take out a FREE 30 day membership trial to read the full report.

Clothing and Footwear year-on-year growth

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted