UK Clothing & Footwear Sector Report summary

October 2024

Period covered: Period covered: 25 August – 28 September 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

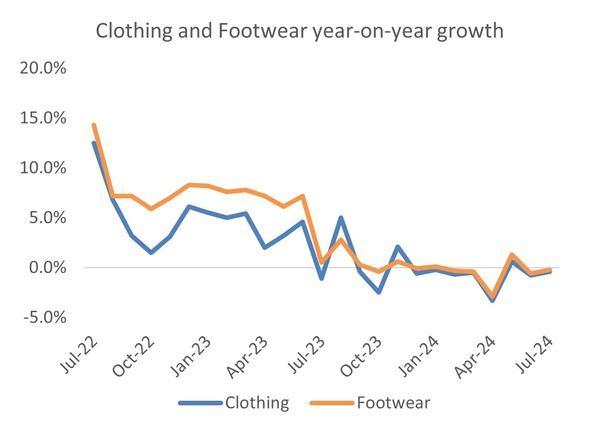

Clothing sales rose xx% YoY, while Footwear sales rose by xx% YoY in September, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Key sales drivers

Clothing & Footwear sales’ performance in September reflects several upside (+) and downside (-) factors including:

Back to school (+): Consumers continued to stock up on back-to-school essentials as children and students returned to school and university throughout September.

Cold and rainy weather (+): The autumn/winter 2024 season was off to a good start for clothing retailers, with sales of new ranges assisted by seasonal weather in September. Seasonal sales were helped by dips into cooler temperatures in the middle and end of the month as consumers started to stock up on coats and jumpers.

Continued inflation (+): Inflation in the clothing and footwear sector stood at xx% in September (ONS), half the rate in August (xx%) and a significant drop YoY, when inflation stood at xx%. Other non-food categories, however, experienced deflation; in values terms, sales of clothing and footwear were helped by continued inflation in the sector.

Consumer confidence drops (-): Consumer confidence fell xx points in September (GfK) as people worried about the impact of the upcoming Budget at the end of October. While consumers are concerned about tax increases impacting disposable income, retailers are worried about business rates.

Improving economic conditions

All eyes are on the Budget on 30th October, with difficult decisions expected on tax, spending, and welfare.

However, despite consumers feeling worried about impending changes, the UK’s economic backdrop continues to improve. Monthly real GDP is estimated to have grown by xx% in August, after no growth in June and July. Housing market activity also continued to recover, with prices rising for a third consecutive month.

Headline inflation rose xx% in September YoY, down from xx% in August (ONS). This marks the lowest level of inflation since April 2021.

The fall in inflation follows a softening in wage growth. The easing of these pressures means the Bank of England is more likely to accelerate interest rate cuts heading into 2025, lowering borrowing costs and potentially boosting consumer spending.

Take out a FREE 30 day membership trial to read the full report.

Clothing and Footwear year-on-year growth

Source: Retail Economics

Source: Retail Economics