UK Clothing & Footwear Sector Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

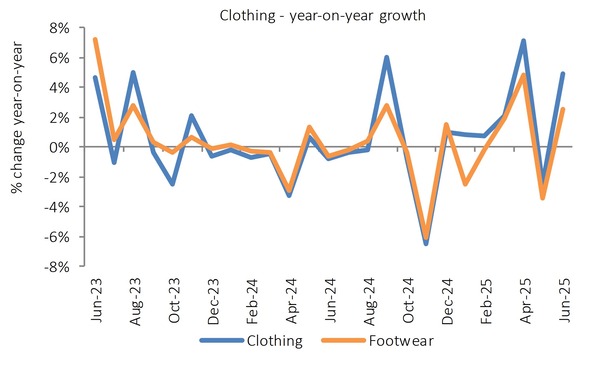

Clothing & Footwear retailers enjoyed a welcome lift in June, with strong seasonal triggers helping to reignite spending across the category. Clothing sales rose by xx% and Footwear sales by xx% YoY, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

This marked a meaningful recovery from June 2024, when both categories were in decline.

Key sales drivers

Clothing & Footwear sales’ performance in June reflects several upside (+) and downside (-) factors including:

- Heatwave (+): The UK experienced its second warmest June since records began, with two heatwaves in mid and late June. The month was sunnier than average.

- Travel and events (+): Festivals, sports events and upcoming holidays gave consumers a reason to refresh wardrobes.

- Budget concerns (-): Headline inflation rose to xx% in June, reinforcing caution as consumer confidence dipped into July.

- Promotional activity (+): Clothing retailers relied on promotions to drive sales, as shoppers remain cautious with their non-essential retail spending.

Seasonal boost

Consumers responded to a combination of warm weather, upcoming holidays, and a packed summer events calendar. Occasionwear, holiday clothing, and casual staples all benefitted, especially where retailers executed well on newness and novelty. The result was a noticeable refresh of summer wardrobes, signalling that shoppers are still willing to spend when timing, relevance and price align.

Retailers responded proactively, using deep and early discounting to clear spring lines while accelerating summer promotions to capture demand. Clothing & Footwear prices ticked up by xx% YoY in June, following two months of deflation.

Travel movements also played an important role in shaping June’s results. With more households planning summer holidays and attending social events, demand for occasionwear and holiday clothing picked up.

Retailers that tailored ranges for travel capsules and event dressing outperformed, while those slower to react to seasonal missions saw more muted results.

Underlying caution

Cost-of-living pressures remained a defining influence. Consumers continued to seek value, and margin pressure persisted across the sector, even as June delivered the first consistent signs of category-wide recovery after a challenging spring.

Transaction volumes rose, although many shoppers remained highly price sensitive. Mid-market and value-focused brands led performance, as consumers leaned on loyalty schemes and sale pricing to stretch household budgets.

This was reflected in GfK’s Consumer Confidence Index, which edged up two points to –xx in June before slipping to -xx in July, indicating cautiousness and the fragility of sentiment compared with the long-term average.

There was also a notable evolution in buying behaviour. Consumers appeared less reactive and more deliberate, blending lower-cost trend-led pieces with investment basics.

This reflects a shift away from the impulse-driven spending of previous summers towards a more curated approach that balances affordability with durability. While discounting underpinned much of June’s sales uplift, it also highlighted an uncomfortable reliance on promotions to unlock demand.

Online growth

Online channels performed especially well during the month (+xx% YoY), aided by convenience and heat-driven avoidance of in-store shopping. Retailers that combined speed with availability and leveraged marketing around major cultural moments gained share, including summer festivals and sports tournaments.

In contrast, store-based footfall presented a flat picture, with footfall up by xx% YoY in June, but performance the varied sharply depending on location, format and week based on weather and live events. Retail parks and city-centre stores linked to leisure or travel flows benefitted the most, while some secondary high streets remained subdued.

Take out a FREE 30 day membership trial to read the full report.

Clothing and Footwear year-on-year growth

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted