UK Clothing & Footwear Sector Report summary

August 2025

Period covered: Period covered: 06 July – 02 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

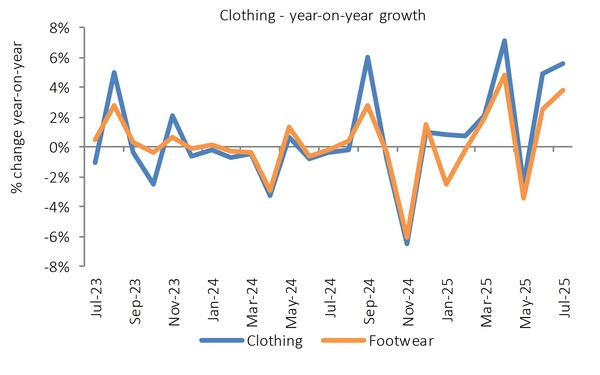

Clothing sales rose by xx% year-on-year in July, while footwear increased by xx%, marking the best combined performance since April.

Seasonal demand, a full calendar of events, and hot weather early in the month helped sustain activity, with apparel emerging as one of retail’s brighter categories.

Key sales drivers

Clothing & Footwear sales’ performance in July reflects several upside (+) and downside (-) factors including:

Seasonal uplift (+): The heatwave at the start of July boosted demand for summer apparel, from dresses and shorts to swimwear and sandals.

Event-driven spending (+): England’s Women’s Euro 2025 win, Wimbledon and weddings helped push sales of sportswear, fan merchandise, and occasionwear.

Price sensitivity (-): Heavy discounting drove volumes, with clearance events starting early and online channels seeing strong engagement.

Shifting wardrobe priorities (+): Holiday and casualwear outperformed, while formal and workwear remained subdued.

Macroeconomic backdrop

Trading in July came against fragile confidence. GfK’s index slipped back to -xx, with households cautious about the wider economy, though still managing day-to-day budgets. Inflation ticked up to xx%, with food and travel driving the rise, leaving discretionary budgets tight.

Wage growth of xx% kept real incomes marginally positive, though uneven across households. Higher earners maintained demand for occasionwear and premium footwear, while value ranges and discount retailers drove much of the overall uplift.

Early signs of stabilisation in the housing market and easing mortgage rates also gave some reassurance, though spending remained focused on immediate seasonal needs rather than long-term wardrobe investment.

Online growth

Online Clothing & Footwear sales rose by xx% YoY in July, the strongest result since March 2025, against a xx% decline a year ago.

Performance was buoyed by widespread promotions and warm temperatures, with some consumers opting to shop from the comfort of their own homes during peak temperatures.

Outlook

Clothing and footwear enjoyed a strong July, but gains were shaped by weather, sport and discounting rather than a broad revival in confidence.

August should benefit from back-to-school and bank holiday demand, while autumn ranges will test whether momentum can be sustained. With shoppers still cautious and selective, performance is likely to remain reliant on timely promotions, seasonal triggers and value-led offers.

Take out a FREE 30 day membership trial to read the full report.

Clothing and Footwear year-on-year growth

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted