UK Clothing & Footwear Sector Report summary

August 2024

Period covered: Period covered: 30 June – 27 July 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx% YoY, while Footwear sales fell by xx% YoY in July, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Clothing & Footwear sales’ performance in June reflects several upside (+) and downside (-) factors, including:

Summer holidays (+): Consumers continue to buy for weddings, summer events and, as the school holidays continue, holidays abroad, with a range of summer activities driving sales as shoppers refresh wardrobes.

Mixed weather (-): Below average temperatures in the first half of the month impacted seasonal sales, despite preparations for days out and holidays abroad. In the second half of the month temperatures soared, with London reaching 32 °C on 30 July, the hottest day of the year so far. Retail Economics’ Shopper Sentiment Survey found that xx% of shoppers have spent less than intended on clothing and footwear over the last three months due to the weather.

Sporting events (+/-): While July’s sporting events – from the Euros to the Olympics to Wimbledon – increased sales of some sportswear, events such as the Euros final on 14 July meant consumers spent on food and drink, and in bars and pubs, at the expense of other categories.

Stabilising economy (+): UK GDP grew xx% in June, double what was expected, after remaining flat in May. The economy grew in the first half of 2024. (ONS)

Sentiment up as inflation back to target

Clothing and footwear sales fell again in July as the weather dampened sales and as consumers continued to prioritise spending in other areas, such as summer holidays.

Summer getaways saw spending on travel rise by a robust xx% during the month, according to Barclays. Travel agents experienced growth of xx% as households continue to spend on experiences abroad, while domestic hotels, resorts, and accommodations saw a xx% decline.

Spending in pubs and bars grew by xx% YoY, the highest since January, driven by the Euros final (Barclays).

Consumer confidence improved by just one point from xx in June to xx in mid-July (GfK). Shoppers remain cautious against a backdrop of high borrowing costs.

Consumer sentiment around making big purchases has improved, but overall, intentions remain deeply negative, overshadowed by perceptions that now is a good time to save (Major Purchase Index at xx versus Savings Index at xx in July). Consumers remain cautious to spend on non-essential retail.

Footfall was “steady” in July compared to June, with high streets seeing increased footfall as people took summer breaks, and football fans came out for England’s matches in the Euros (MRI Software).

Headline inflation grew slightly to xx%, with inflation in the clothing and footwear sector rising to xx% from xx% in June. While promotional activity continues, supply chain challenges continue to apply inflationary pressure.

Take out a FREE 30 day membership trial to read the full report.

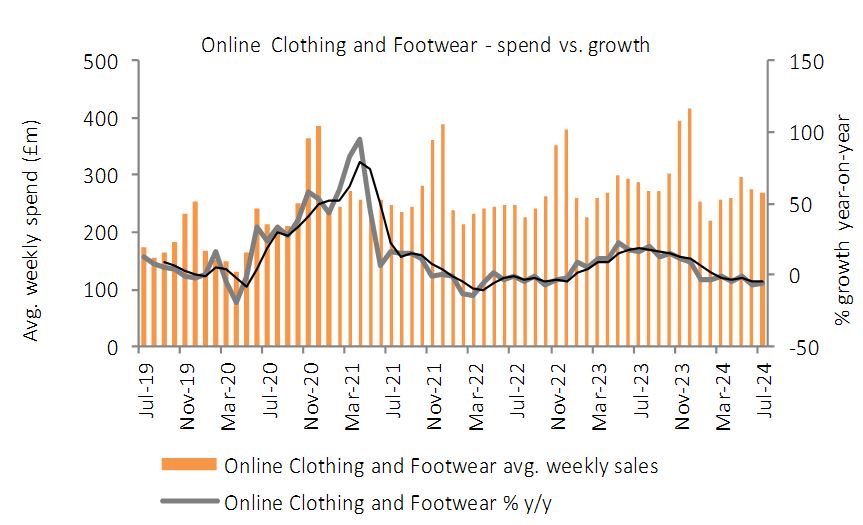

Clothing and Footwear Sales Time Series

Source: Retail Economics, ONS

Source: Retail Economics, ONS